Small cap robotics stocks off to a good start of 2026

Good morning everyone!

There is no better way to kick off Thursday market commentary series, which this month is dedicated to small to mid-cap robotics stocks, than during CES 2026 week.

NVIDIA, Hyundai, Caterpillar, LG, and many more major players showed up in Las Vegas declaring this “the ChatGPT moment for robotics.” Jensen Huang unveiled the Isaac GR00T N1.6 model, Hyundai announced partnerships with both Boston Dynamics and Google DeepMind, and the phrase “physical AI” seems to be the buzz word of 2026.

The most interesting news about small caps was from UiPath (PATH). The company just posted its first GAAP profitable quarter in Q3 fiscal 2026, with revenues climbing 16% YoY to $411 million, thanks in part to their pivoting from traditional robotic process automation to what they’re calling “agentic AI orchestration”. This has solidified their shift from a cash-burning machine to a profitable business model that it is starting to work. In December, PATH was added to the S&P MidCap 400 index, effective January 2026, which typically brings a wave of institutional buying from index funds.

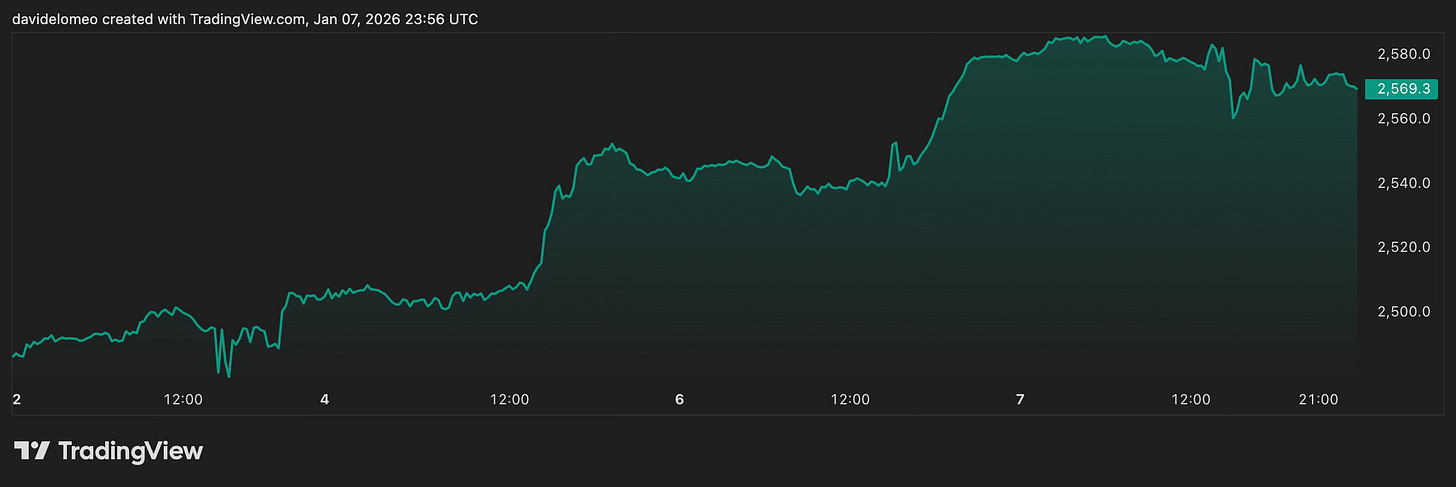

Oshkosh Corporation (OSK) showed up at CES with the JLG Boom Lift with robotic end effector, demonstrations of robotics in aviation and refuse collection that the company is already actively deploying in airports and job sites. Meanwhile, Serve Robotics (SERV) and Richtech Robotics (RR) are up since the 2nd of January roughly 30% and 6%, respectively.

The Russell 2000 surged 6.2% in the first week of 2026, one of the strongest ‘January Effect’ openings in recent history, while the S&P 500 stayed relatively flat. Small-caps entered the year trading at a nearly 26% discount to large-caps, which is close to historic lows. Analysts are projecting 35% earnings growth for Russell 2000 companies over the next two years. That valuation gap, combined with the Federal Reserve’s three consecutive rate cuts bringing rates down to 3.50-3.75%, has created a sector rotation that should benefit small and mid-caps.

The narrative I keep seeing is that 2024 and 2025 were about large language models and data centers, while 2026 is positioned as the year of robotics and domestic manufacturing. If that thesis plays out, then remains to be seen whether small and mid-cap robotics companies benefit from the sector momentum that NVIDIA and Hyundai are creating, or whether they remain completely overshadowed.

The setup is there. Small-cap valuations are depressed, earnings growth projections are strong, and the entire robotics sector just got a massive PR boost from CES. What I’m watching for next week is whether any of these small and mid-cap names actually move on the CES announcements, or whether all the momentum stays concentrated in the mega-caps that were on stage. The former would confirm the rotation thesis. The latter would tell us the valuation gap has further to widen before institutions start looking down the market cap ladder.

Either way, we’re about to find out if “the ChatGPT moment for robotics” includes companies below $10 billion in market cap, or if this is just another cycle where small-caps watch from the sidelines.

The CES narrative is powerful, but the real test will be whether capital follows it beyond NVIDIA & friends. Small-cap robotics look attractively priced, yet they’ll need tangible order growth to avoid being another “wait your turn” cycle.