Why US small and mid-cap robotics stocks could be the surprise of 2026

Last week, as I was thinking about what to write for my first Substack post ever, I thought there would be no better way than to talk about something I know little about.

Sounds silly, but stay with me.

The idea behind this post, this newsletter, this whole account for that matter, is that after 5 years of investing, and 4.5 years of a (very isolating) doctoral research, I wanted to start sharing my thoughts and investing journey with others, and in the process, create a community of fellow investors.

I promised myself to start this in 2026 by sharing my perspectives on how to look at the stock market with discipline and help others escape the FOMO when stocks are ‘hot’. I have made countless mistakes over time, and certainly have had a few very lucky bets.

A way to do this, I thought, would be to explore the usually underserved market of small- to mid-cap US stocks, and especially researching sectors I have no current exposure to, and share my thoughts and ideas with others.

One such sector is robotics.

I spent last week looking at data on industrial robot installations, reading through market reports, and trying to figure out what’s actually happening in this sector beyond the Tesla Optimus videos everyone shares on X or TikTok. I found that the economics of this sector have shifted dramatically over the past few years, and while I see very well known people stating the uselessness of anthropomorphic robots, the market is actually showing to be very dynamic, and growing.

The numbers

There are roughly 600,000 unfilled manufacturing jobs in North America right now. These are assembly jobs, material handling, the repetitive stuff that robots can actually do with current technology. And the demographic data says this isn’t getting better, since workers are aging, fewer people are entering these roles, and factories cannot staff their production lines.

While a standard industrial robot installation cost around $200,000 in 2022, today the same installation, with the same capabilities, costs about $80,000. When you’re hiring and training new workers at 15-20% higher wages than two years ago, spending $80,000 on a robot that works 24/7 starts making a lot of (economic) sense.

LiDAR sensors, which robots use to see the surrounding environment, cost thousands of dollars per unit five years ago, while today you can get them for under $500. Battery energy density has improved 50% over the last decade while costs have fallen 80%. And AI vision systems can now identify objects with 95%+ accuracy in most conditions, compared to 70-80% accuracy in 2020.

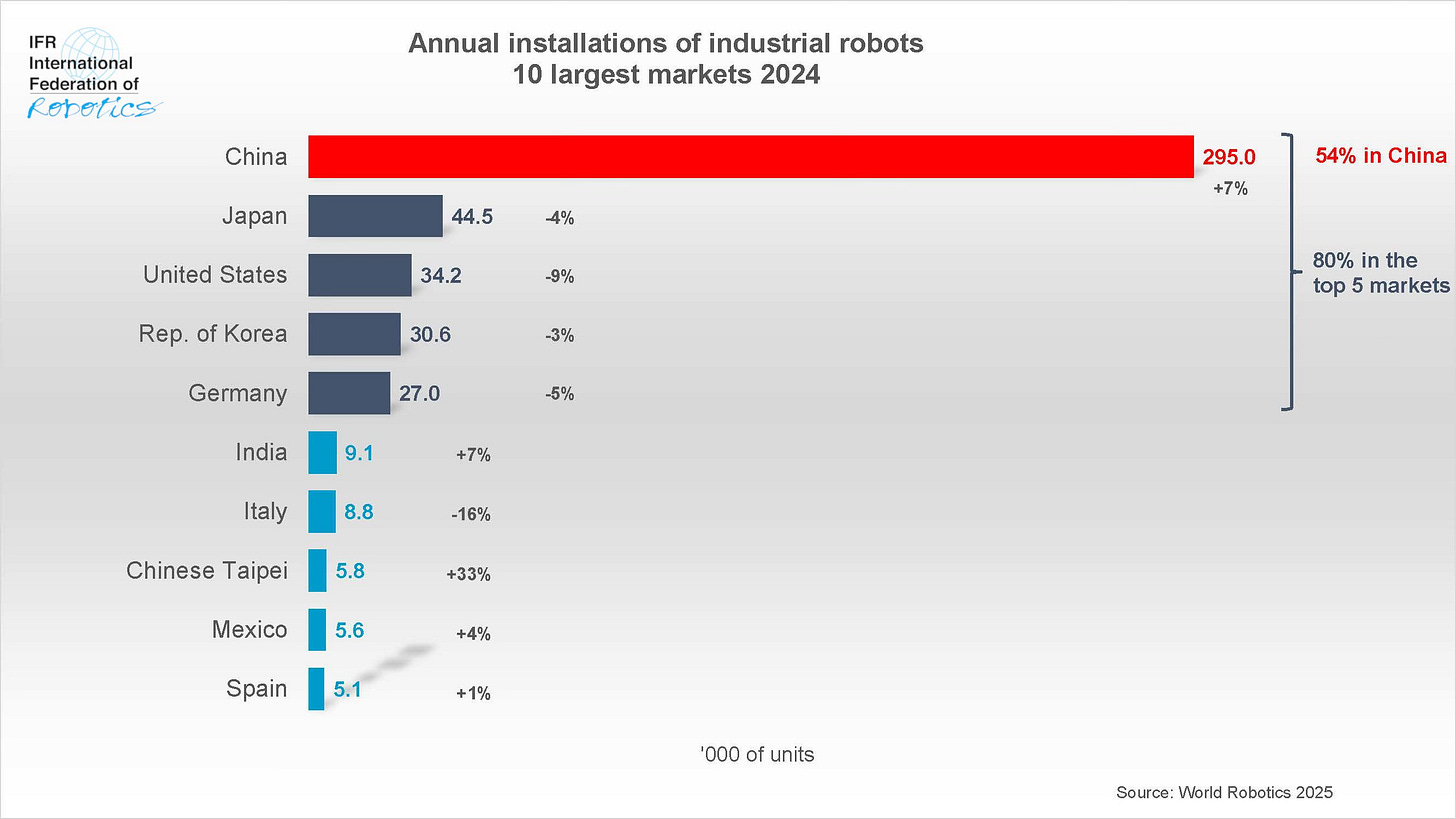

China alone installed 295,000 industrial robots in 2024, accounting for 54% of global robot deployments. This is because China’s manufacturing sector is massive, their wages are rising fast, and they likely recognized earlier that automation was the path to staying competitive. The US is lagging way behind at around 34,000 units installed in 2024.

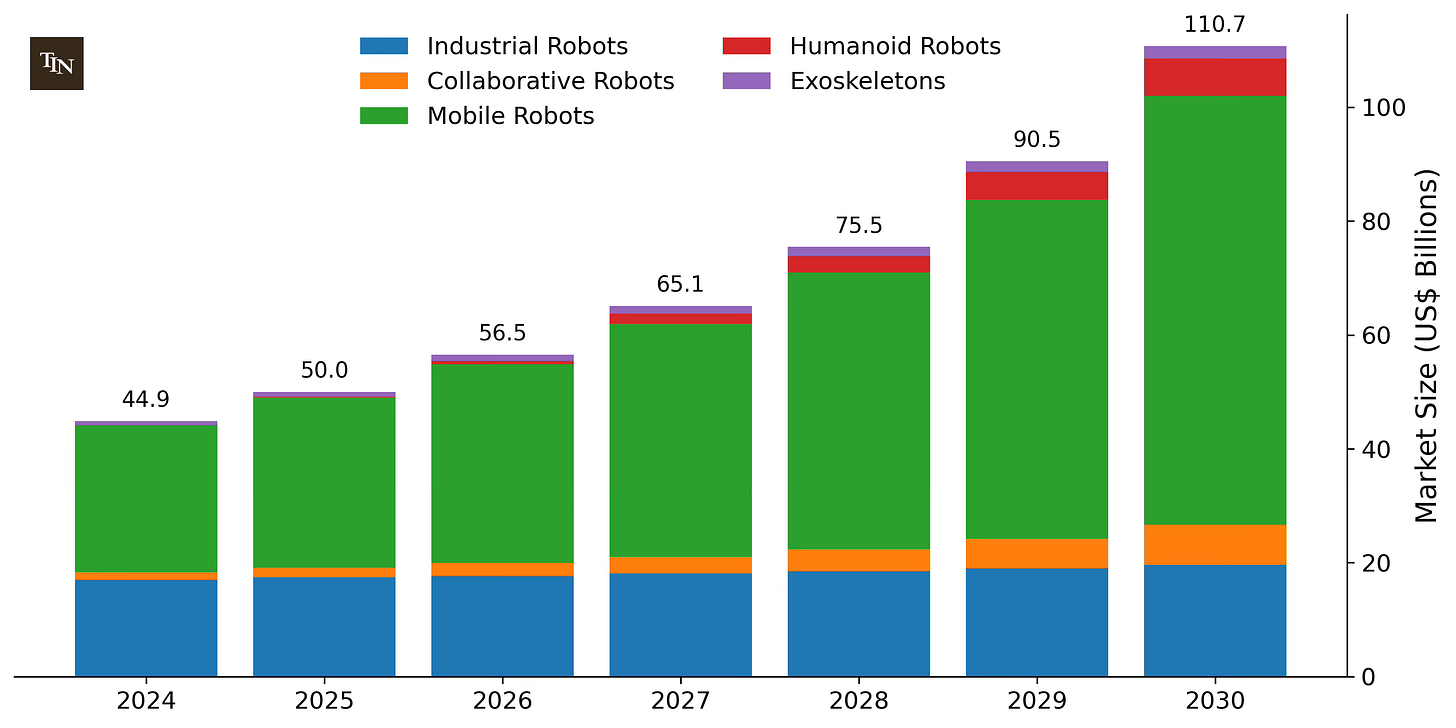

The market is projected to grow from $50 billion in 2025 to $111 billion by 2030, with five segments cumulatively growing at a 14% compound annual growth rate.

Then there are three segments that I genuinely did not think belonged to this category, and these are drones, counter-drones, and software robots (!!).

The Robotic Process Automation software (RPA) market, which automates office tasks and workflows, was $3.8 billion in 2024 and is projected to hit $30.9 billion by 2030, growing at 44% annually. This software can process thousands of invoices at a cost of roughly $15,000 per year, which is an obvious advantage from paying three full-time employees doing the same work at $180,000 in salary costs alone.

The US military drone market is growing at 12.9% annually, from $13.7 billion in 2024 to $28.2 billion by 2030. In December 2025, the FCC banned Chinese-manufactured drones from US government use, creating an overnight regulatory moat for domestic manufacturers. Suddenly, every defense contractor needs NDAA-compliant components, and there are only a handful of US-based suppliers who can provide them. That’s not a robotics thesis in the ‘conventional’ sense, but it’s absolutely an autonomous systems investment opportunity.

The counter-drone market, systems designed to detect and neutralize unauthorized drones, is growing at 27.2% annually, and It’s projected to grow from $2.5 billion in 2025 to $10.6 billion by 2030. This technology is now an essential infrastructure for airports, military bases, and critical facilities because cheap commercial drones have become sophisticated enough to be legitimate security threats (look at what is happening with the war in Ukraine).

Where I am looking next

Everything I just described, labor shortages, falling costs, expanding applications, are all sector-wide tailwinds. But when I looked at the investable universe of US-listed stocks, I found something interesting.

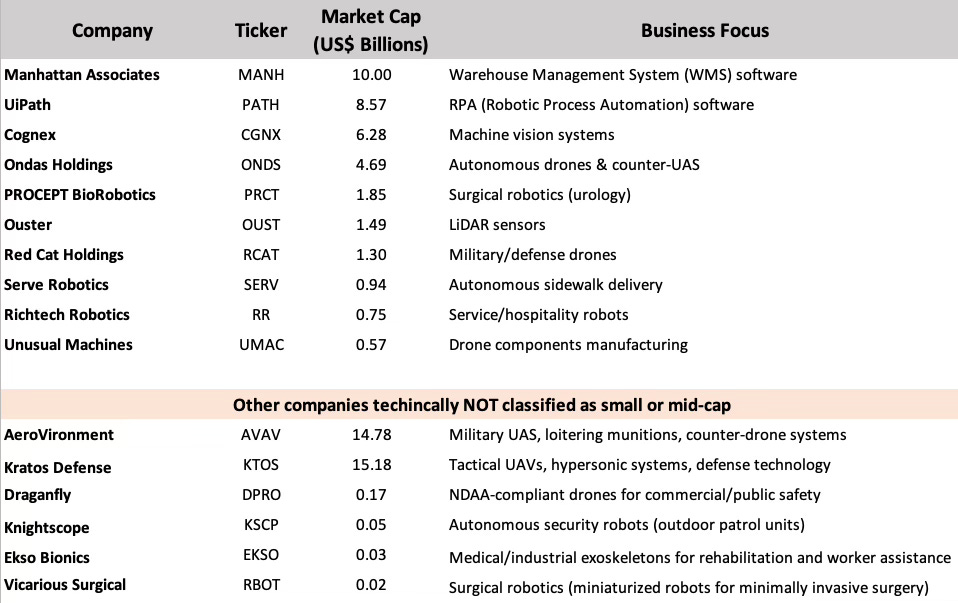

There are only 10 US-listed robotics companies with market caps between $300 million and $10 billion (small- to mid-cap).

That’s it. A sector projected to hit between $111 billion and $181 billion (if you extend to drone and software robots) by 2030, and there are only 10 mid-sized public companies (in very strict terms) focused purely on robotics. Everything else is either very small (micro-caps), private, or a division or acquisition of a much larger company. The fastest-growing sub-sectors I mentioned have almost no public pure-plays in that middle market cap range in the US.

Let’s keep in mind that the list of companies would be larger if we added American Depositary Receipts (ADRs) and foreign ordinaries, such as Kraken Robotics (KRKNF), or Yaskawa Electric (YASKY).

But why does this matter?

Because Wall Street analysts from JPMorgan and Bank of America are calling for small and mid-cap stocks to outperform large caps in 2026. Their thesis is that everyone is crowded into the Magnificent 7, valuations are stretched, and there is a natural rotation coming. If this thesis plays out, and if robotics fundamentals keep improving, the handful of mid-cap pure-plays might be worth understanding more deeply.

Tom Lee himself (co-founder of Fundstrat and chairman of Bitmine Technologies - like him or not, he has been right time and time again about the market) said that tariffs anniversary(ing) and a dovish FED further cutting rates, may finally get the ISM above 50, which is ultimately going to be a catalyst for small-caps.

I’m definitely not saying that I’m buying anything yet, but the setup is interesting enough that I want to spend this month really understanding these companies. I’m starting from scratch, I don’t own any robotics stocks, and I’m going to share exactly what I find as I find it, and that’s the whole point. I want to document my research, my process, and share them with others.

Over the next three weeks I'll be digging into these companies, and will pick two that I think have the most compelling story and share my deep-dive research, so stay tuned!

Disclaimer

This newsletter is for educational and informational purposes only. Nothing I write constitutes financial advice, investment recommendations, or a solicitation to buy or sell any securities. You should not make investment decisions based solely on my analysis. Always do your own due diligence, consult with qualified financial advisors, and consider your individual circumstances before making any investment. All analysis and opinions are my own and can be wrong. Markets are uncertain, and even well-researched ideas can lose money. I am not a licensed financial advisor and accept no liability for any losses resulting from the use of information in this newsletter.

If this piece helped you, like it, share it, or repost it on Substack, it really helps my work reach more readers like you, and consider subscribing to receive new posts directly to your inbox!