CES was not that revealing for small cap robotics stocks

Good Morning!

In last week’s market commentary I asked whether small and mid-cap robotics companies would catch momentum from the 2026 CES “ChatGPT moment for robotics” narrative. The answer was pretty clear. They just didn’t.

While NVIDIA, AMD, and Qualcomm dominated Las Vegas with humanoid robot demonstrations and partnership announcements, the small-caps that should theoretically benefit from sector enthusiasm mostly traded sideways or down. Serve Robotics (SERV) sits at $14.24, down 11.06% over the past three months, despite the most recent surge of 20% over the past month, and while being one of the few pure-play autonomous delivery names with actual deployments. Richtech Robotics (RR) dropped 42% over the same period, bleeding from October’s $7 peak down to the $3-4 range as the robotics momentum trade unwound.

Companies like UiPath (PATH), while not strictly a hardware robotics company, but more of a software robotics one, jumped 40% in December after its addition to the S&P MidCap 400 index and reporting its first GAAP profitable quarter (i.e., Q3 2026). However, the stock has almost lost all its gained ground, and it is now sitting at about $15.4 (or -24% from that peak). The strength of the stock was ignited by institutional buying triggered by these events, as opposed to things related to the broader sector, and or fundamental innovations from the company. At the same time, small cap companies actually building hardware, such as delivery or service robotics couldn’t capitalize on the sector narrative that large-caps largely dominate.

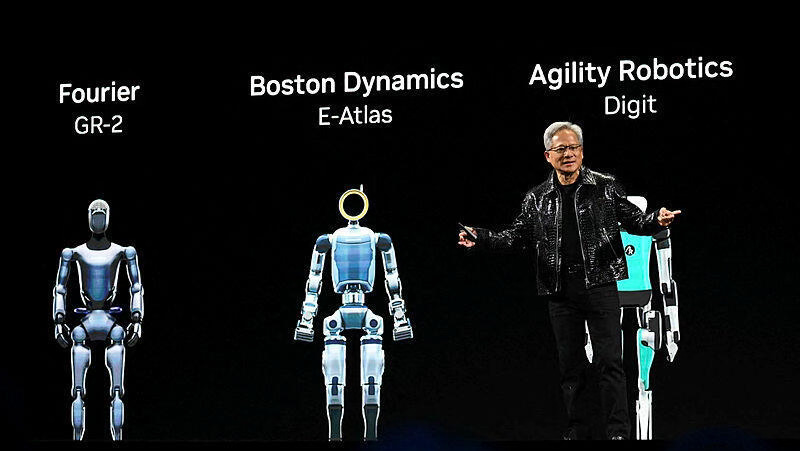

The pattern from CES week suggests capital followed brand names and ecosystem plays, somewhat ignoring the progress made by deployment-stage companies. When Jensen Huang brought humanoid robots on stage at NVIDIA’s keynote, investors bought NVIDIA. When Hyundai announced its partnership with Boston Dynamics and Google DeepMind to deploy Atlas robots in factories by 2028, the market processed it as validation for the mega-cap AI infrastructure thesis, not as a signal to rotate into smaller robotics pure-plays. The Russell 2000’s 6.2% surge in early January has represented more of a broad small-cap rotation driven by valuation gaps and rate expectations, but within robotics specifically, that rotation does not seem to have materalized yet.

This doesn’t mean small-cap robotics companies aren’t executing. Serve continues expanding with Uber Eats. UiPath’s profitability milestone demonstrates software-based automation can scale to attractive unit economics. But CES 2026 has revealed something important about market structure, and that is that robotics as a theme generates enthusiasm that concentrates in companies with diversified revenue streams and balance sheet strength to fund multi-year development cycles. The small-caps need a different catalyst than sector hype to drive sustained moves.

UiPath, which seems to be one of the most hyped robotics stocks so far, reports fiscal Q4 2026 earnings in mid-March, which will test whether its profitability trajectory continues and whether agentic AI orchestration revenue, its most recent pivot, justifies current valuation. For Serve Robotics, deployment numbers are fundamental or quarterly robot count updates - I have recently covered the company in detail on this deep-dive - will be the actual signal. Richtech needs to hold the $4 level technically to avoid further capitulation, but fundamental catalysts remain sparse. The broader test is whether the February earnings season provides concrete deployment metrics that can shift the narrative from mega-cap infrastructure plays to companies actually putting robots in the field (or in the factories).

If this piece helped you, like it, share it, or repost it on Substack, it really helps my work reach more readers like you, and consider subscribing to receive new posts directly to your inbox!